In today’s digital world, IT assets are fundamental to most organizations. They act as their core operational support and are pivotal in enhancing their market value. Efficient inventory management and asset tracking ensure operational effectiveness, financial responsibility, and security.

This is where IT asset audits become essential. These audits provide a comprehensive and accurate view of an organization’s IT infrastructure, encompassing everything from hardware like servers and laptops to software licenses and cloud services.

Whether performed internally or by external parties, IT asset audits offer valuable insights for optimizing resource allocation, maintaining compliance, and reducing risks associated with outdated or underused technologies.

But what are the differences between internal and external IT asset audits, and when should one be preferred? This blog will delve into these questions, exploring the distinct roles, processes, and best practices associated with both types of audits.

Importance of IT Asset Audits

A successful asset audits are crucial in ensuring organizations have complete control over their digital and physical assets. As businesses grow, so does their collection of IT tools, services, and resources.

Managing these assets can become a nightmare without proper knowledge, leading to inefficiencies, budget overruns, and even security vulnerabilities. Regular audits help organizations keep track of their assets, ensuring that they are properly utilized, compliant with licensing agreements, and secured from potential risks.

Moreover, the IT asset audit process supports organizations in adhering to regulatory standards and preparing for compliance reviews. Whether it’s ensuring that software licenses are not expired or that hardware is up-to-date, audits provide critical insights into the operational health of an organization’s IT ecosystem.

Brief Overview of Internal and External Audits

An audit generally refers to systematically examining or evaluating records, processes, systems, or operations to assess accuracy, compliance, or effectiveness. The primary goal of an audit is to ensure that the subject being audited aligns with the established standards, policies, or regulations.

IT asset audits can be broadly categorized into internal and external. Internal audits are conducted by the organization’s team, often within the IT department or a designated audit group. They focus on improving the efficiency and management of assets from an insider’s perspective.

External audits, on the other hand, are conducted by third-party organizations or specialists. These audits offer an independent review, providing objective visions into the organization’s IT asset management practices and helping organizations prepare for regulatory or financial audits.

Now, you must be wondering which type of audit is essential or which type should be conducted when, where, and how. No worries; we are here to sort everything out. Both types of audits are essential, but they serve different purposes and follow different processes. Understanding their distinctions can help organizations decide when and how to conduct these audits.

What are Internal IT Asset Audits?

An internal IT asset audit is an assessment conducted within an organization to check i’s IT resources. Internal auditors, IT staff, or a dedicated team responsible for managing the company’s technology infrastructure usually carry it out.

They aim to ensure that the organization uses IT assets efficiently, maintains them properly, and aligns them with organizational objectives.

This type of audit allows organizations to maintain tighter control over their IT infrastructure. It helps identify underutilized or obsolete assets. It ensures that software licenses are up-to-date, and mitigates internal risks like, unauthorized software use or outdated systems that could lead to security breaches.

Now that we understand internal audits, let’s discuss the audit process and its key steps.

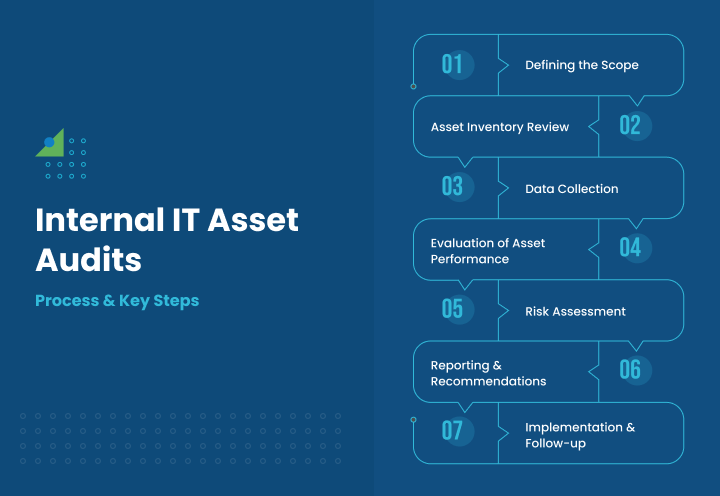

Process and Key Steps:

The process of conducting an internal IT asset audit typically involves several key steps:

- Defining the Scope: The first step in an internal audit is determining the scope. This may include hardware, software, networks, data storage devices, and cloud services.

- Asset Inventory Review: The organization compiles a comprehensive list of all its IT assets, including physical hardware, software licenses, and cloud services. This inventory is then cross-referenced with financial records and operational data.

- Data Collection: Internal auditors gather data on how these assets are used and maintained and whether they comply with the organization’s policies. This includes information on software licenses, hardware utilization, and user access logs.

- Evaluation of Asset Performance: The audit team evaluates each asset’s performance and efficiency. For instance, are certain hardware assets underused, or are there software licenses that haven’t been utilized in months?

- Risk Assessment: Identifying potential risks, such as unauthorized software use, outdated systems, or over-licensed software, is a critical aspect of an internal audit.

- Reporting and Recommendations: Once the data is collected and analyzed, the team prepares audit reports that highlight areas of concern, provide recommendations, and suggest actions for improvement.

- Implementation and Follow-up: After the audit, the organization will implement recommended changes and follow up to ensure ongoing compliance and efficiency.

What are External IT Asset Audits?

An external IT asset audit is an assessment conducted by a third-party firm or consultant not belonging to one’s organization. Unlike internal audits, which focus on internal processes and operational improvements, external audits provide an independent, objective evaluation of an organization’s IT assets and their management.

These audits are beneficial when organizations must ensure compliance with external regulations, prepare for financial audits, or receive unbiased insights into their asset management practices.

External audits also carry more weight when reporting to stakeholders, investors, or regulatory bodies, as they independently verify the organization’s practices and compliance with industry standards.

Process and Key Steps

External audits follow a similar structure to internal audits but with the participation of external professionals who may not be familiar with the organization’s internal workings. The steps typically include:

- Initial Consultation and Planning: The external auditor meets with key organizational stakeholders to define the audit’s scope, identify critical assets, and establish specific objectives (such as ensuring compliance with regulatory standards).

- Data Collection: External auditors gather information from various systems, departments, and personnel, often utilizing specialized tools to scan the organization’s network for hardware, software, and cloud services.

- Independent Verification: A crucial aspect of an external audit is the independent verification of the provided data. To ensure accuracy, auditors cross-check the organization’s records against actual asset usage, software licenses, and physical inventories.

- Regulatory Compliance Review: External auditors ensure compliance with industry regulations and legal requirements. This includes verifying valid software licenses, checking for cybersecurity vulnerabilities, and assessing data protection practices to meet regulatory standards.

- Objective Analysis: External auditors conduct an impartial evaluation of the organization’s asset management procedures, identifying inefficiencies, risks, and opportunities for improvement.

- Final Report and Recommendations: Upon completing the audit, the external auditor delivers a comprehensive report detailing their findings and offering actionable recommendations to enhance asset management processes.

- Follow-up Audit: In some cases, a follow-up audit is performed to ensure that the recommendations have been implemented and that the organization is progressing toward continuous improvement.

Key Differences Between Internal and External IT Asset Audits

The key differences include the following.

| Internal Audits | External Audits |

|---|---|

| The primary objective of an internal IT asset audit is to optimize the organization’s asset usage, ensure internal compliance with policies, and improve operational efficiency. | An external IT asset audit is generally conducted with the goal of providing an independent review, ensuring compliance with external regulations, and delivering unbiased insights. |

| They are often focused on identifying ways to reduce costs, improve processes, and mitigate internal risks. | They are particularly useful for regulatory compliance, financial reporting, and satisfying stakeholders who require an objective assessment. |

| These are conducted by internal teams. | These are conducted by special external or independent auditor teams or professional consultants. |

Process and Methodology

While the processes for both types of audits involve data collection, verification, and analysis, the methodology differs due to the auditors’ roles. Internal auditors have a deeper understanding of the organization’s systems, processes, and policies. This allows them to focus on operational improvements aligning with the organization’s goals.

External auditors, however, bring a fresh perspective. They approach the audit independently, often using standardized methodologies to ensure compliance with industry regulations and best practices.

Benefits and Challenges

Benefits

| Internal Audits | External Audits |

|---|---|

| Greater flexibility in scope and focus. | Independent, objective assessment. |

| Deeper understanding of internal processes. | Expertise in regulatory compliance and industry best practices. |

| Opportunity for continuous improvement and cost reduction. | Adds credibility when reporting to stakeholders or preparing for financial audits. |

Challenges

| Internal Audits | External Audits |

|---|---|

| Potential for bias or lack of objectivity. | More costly than internal audits. |

| Limited by internal resources and expertise. | External auditors may lack familiarity with specific internal processes. |

| May miss broader industry standards or compliance issues. | Potentially more disruptive to day-to-day operations due to external involvement. |

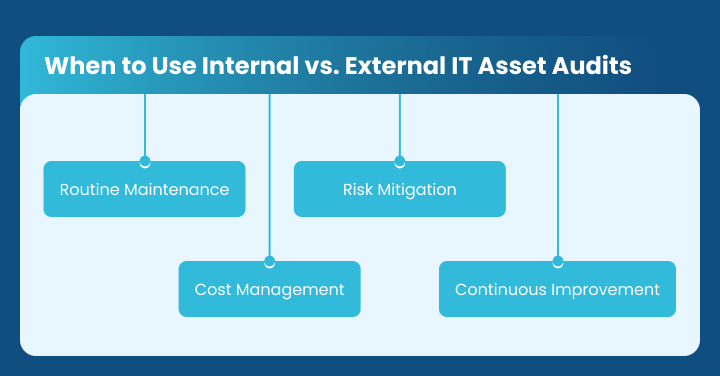

When to Use Internal vs. External IT Asset Audits

Situations Best Suited for Internal Audits

Routine Maintenance:

Internal asset audits are well-suited for regular IT asset assessment to ensure they function optimally. This includes routine checks on hardware and software to confirm that everything is up-to-date and operating efficiently.

For example, organizations conduct internal audits to verify that they have applied all software patches, ensured hardware is in working order, and aligned systems with company policies. By conducting regular asset audits, businesses can avoid potential issues such as hardware failure, unauthorized access, security vulnerabilities, or outdated software, all of which could lead to costly disruptions.

Cost Management:

Internal auditing is crucial in helping an organization manage its IT expenses while ensuring compliance with accounting standards. By leveraging asset management software to review asset usage, the audit can identify underutilized hardware or software that may inflate costs without adding significant value. For example, the audit might reveal servers that are no longer necessary or unused software licenses.

With this information, the organization can reduce unnecessary expenses by eliminating redundant assets or reallocating resources more efficiently. This process reduces IT costs and ensures accurate asset values are reflected, improving overall financial efficiency.

Risk Mitigation:

An internal audit is vital in helping an organization manage its IT expenses while supporting effective risk management. Through thorough asset auditing, the audit can identify underutilized hardware or software that may inflate costs without contributing significant value.

For example, it might uncover no longer necessary servers or unused software licenses. With this information, the organization can reduce unnecessary expenses by eliminating redundant assets or reallocating resources more efficiently. This process reduces IT costs and ensures accurate asset values, ultimately improving overall financial efficiency.

Continuous Improvement:

An internal audit is essential for fulfilling the **purpose of an asset audit to help an organization manage its IT expenses and ensure efficient use of the company’s assets. The audit can identify underutilized hardware or software that may drive up costs without providing significant value by reviewing asset usage.

For example, it might reveal unnecessary servers or unused software licenses. With this information, the organization can reduce unnecessary expenses by eliminating redundant assets or reallocating resources. Additionally, this process helps ensure compliance with **relevant regulations** and guarantees accurate asset values, improving overall financial efficiency.

Situations Best Suited for External Audits

Regulatory Compliance:

An external audit is often the best approach when an organization must comply with external regulations, such as software licensing agreements, industry standards, or data protection laws.

External auditors bring an unbiased perspective, ensuring the organization’s practices align with all relevant legal and regulatory requirements. Businesses in heavily regulated industries, such as finance, healthcare, or telecommunications, must comply to avoid fines, legal consequences, or reputational damage.

Financial Audits:

External asset audits are essential when preparing for a financial audit or when organizations must provide stakeholders with an impartial assessment of their IT assets.

In these scenarios, financial transparency and accuracy are critical. An external IT asset audit ensures the organization correctly accounts for its IT assets and accurately reflects their value in financial statements. It also reassures investors, board members, and regulatory bodies that asset management practices align with financial reporting requirements.

Independent Verification:

One of the primary advantages of an external auditing process is its objective verification. External auditors provide an independent review of the organization’s asset management practices, free from internal biases or conflicts of interest.

This independent verification adds credibility to the organization’s reporting, particularly when engaging with investors, regulators, or partners. For example, an external audit can validate that the organization uses licensed software correctly, manages cloud services efficiently, and safeguards critical IT infrastructure.

Preparation for Acquisitions or Mergers:

External audits are invaluable for mergers or acquisitions. These audits provide potential buyers or partners with a transparent, accurate overview of the organization’s IT assets, which is critical during the due diligence auditing process.

An external auditor can assess asset records for accuracy, confirm software license validity, and ensure IT systems align with industry best practices. Additionally, external audits help identify risks, inefficiencies, or areas needing improvement before an acquisition or merger.

Conclusion

Internal and external IT asset audits are vital in maintaining an organization’s IT infrastructure’s health, efficiency, and security. While internal audits focus on operational improvements, cost management, and ongoing efficiency, external audits offer an independent, objective evaluation of compliance, regulatory adherence, and asset management practices.

The key differences lie in the objectives, methodology, and benefits each provides. Internal audits allow organizations to continuously improve from within, focusing on the nuances of internal processes. External audits, on the other hand, deliver credibility, expertise, and independent verification, which can be crucial in regulatory environments or when preparing for significant business operations such as financial audits, mergers, or acquisitions.

Organizations should balance both types of audits, using internal audits for regular maintenance and process improvement and external audits for ensuring compliance and independent assessments. Implementing a strategy that includes both internal and external IT asset audits will ultimately lead to better asset management, more informed decision-making, and improved overall performance.

By understanding the differences and benefits of each audit type, organizations can effectively plan and execute audits to maintain optimal IT asset control, compliance, and financial health.

FAQs:

The advantages of conducting internal IT asset audits are:

- Cost Efficiency

- Improved Compliance

- Enhanced Risk Management

- Operational Efficiency

- Continuous Improvement

The key aspects to look for include:

- Expertise and Credentials: Ensure they have relevant certifications and industry experience.

- Industry Experience: Choose a provider familiar with your industry’s specific needs.

- Reputation: Verify references and reviews from the old clients.

- Compliance Knowledge: They should understand relevant regulations and standards.

- Technology: Use of advanced tools for accurate auditing.

- Communication: Clear, transparent reporting and communication.

- Cost and Flexibility: Competitive pricing and adaptable services.

- Follow-Up Support: Assistance with implementing recommendations and follow-up audits.

Business can prepare for an external IT asset audit in the following ways:

- Inventory Review: Update and verify all asset records.

- Documentation: Ensure all licenses, contracts, and compliance documents are organized and accessible.

- Access: Provide the audit team with necessary access to systems and facilities.

- Internal Review: Conduct a preliminary internal audit to identify and address potential issues.

- Staff Preparation: Inform and prepare relevant staff about the audit process and their roles.

- Data Backup: Ensure all critical data is backed up and secure.

The disadvantages of external IT asset audits include:

- Cost: External audits can be expensive compared to internal audits.

- Disruption: The audit process might disrupt regular business operations.

- Limited Familiarity: External auditors may not be as familiar with the organization’s specific systems and practices.

- Time-Consuming: The process may take longer due to coordination and data gathering.

- Confidentiality: Sharing sensitive information with external parties can raise privacy concerns.